A brand-new employer-based initiative aims to tackle workplace tension and boost efficiency by supplying totally free debt resolution solutions. With united state customer financial debt at a document $17.05 trillion, this program offers workers with individualized techniques for monetary alleviation and stability.

A brand-new program focused on lowering workplace tension and improving performance with employee financial obligation resolution services is being released by business owner David Baer and his partners. The effort, which is offered to companies free-of-charge, addresses the expanding monetary stress dealing with American employees and their effect on service efficiency.

According to a current research study by Experian, united state customer financial debt reached a document $17.05 trillion Improving Menopause Health Naturally in 2023. Credit card equilibriums climbed by over 16% in one year, and nearly fifty percent of Americans now lug revolving debt. These economic strains are adding to increased worker stress and anxiety, absenteeism, and reduced efficiency across different industries.

Identifying this challenge, Baer, that experienced the hardships of financial debt after a company endeavor stopped working, led this program to use useful relief to workers. "I recognize firsthand the psychological toll that financial obligation can handle a person," Baer stated. "Our mission is to give employees the tools to solve their financial debt so they can concentrate on their individual and professional objectives."

The program is created to be obtainable and adaptable. Companies can implement it effortlessly at no charge, giving their workforce access to customized financial obligation resolution services. Furthermore, individuals can sign up in the program independently through Financial debt Resolution Providers.

Baer highlighted that this initiative is not just a win for staff members but additionally for companies looking for to lower turn over and absenteeism. " Monetary tension doesn't simply stay at home; it walks right into the workplace each day," Baer discussed. "By sustaining workers in overcoming their monetary burdens, companies can foster a extra involved, faithful, and efficient workforce."

Trick features of the debt resolution program consist of:

Personalized Financial Obligation Reduction Strategies: Staff members collaborate with specialists to develop personalized methods based upon their special financial situations.

Lawful Guidance: Partnered with a financial obligation resolution law office, the effort makes sure individuals obtain skilled suggestions to navigate complex financial debt issues.

Financial Wellness Resources: Individuals access to educational products that promote long-term economic health and wellness and proficiency.

The campaign straightens with research study showing that workplace wellness programs attending to economic well-being bring about higher staff member fulfillment and retention prices. In fact, business that invest in such programs report a 31% decrease in stress-related absenteeism and an ordinary performance boost of 25%.

" Economic anxiety doesn't remain at home-- it comes to deal with you," Baer highlighted. "Our initiative supplies firms a means to proactively address this issue. When workers feel empowered to take control of their funds, they end up being a lot more concentrated, inspired, and faithful to their companies."

Why Resolving Financial Wellness Is Key to Workforce Security

The American Psychological Organization (APA) has constantly reported that economic problems are just one of the top sources of stress for adults in the united state Over 70% of respondents in a current APA study mentioned that money problems are a considerable stress factor in their lives. This tension has direct implications for work environment performance: staff members distracted by personal financial issues are most likely to experience exhaustion, miss out on deadlines, and look for brand-new task opportunities with higher wages to cover their debts.

Economically worried workers are additionally more susceptible to wellness concerns, such as anxiousness, depression, and high blood pressure, which contribute to enhanced medical care prices for companies. Addressing this problem early, with extensive financial obligation resolution solutions, can mitigate these threats and cultivate a much healthier, much more stable workforce.

Baer's vision for the program expands beyond prompt treatment. He hopes it will certainly militarize a wider social shift in exactly how companies watch employee wellness. " Business have made fantastic strides in acknowledging the value of psychological wellness and work-life equilibrium. Financial health must be viewed as similarly vital," Baer said. "Our objective is to make financial debt support programs a conventional benefit in work environments throughout the nation."

Program Availability and Next Steps

Companies and human resources professionals curious about supplying the financial debt resolution program can see DebtResolutionServices.org for more details on execution. The site provides an introduction of services, FAQs, and accessibility to program specialists that can help tailor the effort to fulfill the specific demands of a firm's labor force.

The program is just as available to people outside of a formal company offering. Staff members that do not have access with their office can sign up directly on the exact same site to start receiving assistance for their financial debt challenges.

Baer wrapped up, "This program is about greater than just numbers. It has to do with restoring comfort to numerous Americans and giving them a pathway to economic liberty. When workers flourish monetarily, the entire company advantages."

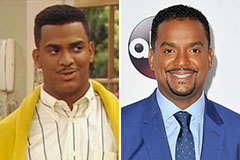

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now!